Beyond the Grid Mix: Leveraging the Utility of Energy Attribute Certificates (EACs)

Written By: Anoud Al-Maashari | Date: April 23, 2024

Many companies today are dedicated to reducing their carbon footprint to achieve both short-term and long-term decarbonization targets. Energy consumption, particularly in the form of electricity use, is often a large component of a company’s emissions profile. However, when companies are unable to install / use renewable energy sources within their premises and are aware that renewables are part of the national grid mix, how can they leverage this to their advantage and claim the use of renewables? Grid-sourced electricity, often originating from a mixture of two or more primary fuel sources, poses a unique challenge. Electrons in the grid lack physical traceability, making it impossible to directly determine the exact source from which you as a consumer are purchasing your electricity. Given this limitation, how can companies leverage the use of and make claim to renewable energy consumption from their grid-electricity purchases?

The only way to do that is through a Book and Claim (Chain-of-Custody) tracking system. In several countries and energy markets around the world, instruments have been developed to track energy production information (or its “attributes”) separately from actual energy delivery. These instruments, referred to as Energy Attribute Certificates (EAC), travel from energy generation facilities to suppliers and eventually to consumers. They serve to validate consumer claims regarding the type of energy utilized and its associated attributes, including greenhouse gas (GHG) emissions generated at the point of production. This process entails an ex-post analysis, simply documenting past events—for instance, measuring solar MWh injected into the grid using meters at power plants and subsequently issuing certificates based on these measurements.

It's important to note that the concept of Energy Attribute Certificates (EAC) remains consistent globally. However, different schemes or regulators manage the tracking process, depending on the purpose of the claim and whether it relates to a regulated or voluntary market. This is illustrated in Europe through initiatives like the Renewable Energy Directive (RED), which mandates that both electricity providers and consumers must utilize Guarantees of Origin (GOs) to substantiate claims related to renewable electricity usage in the region. Similarly, the United States has in place the Renewable Energy Portfolio Standard (RPS) which requires power companies to generate a certain percentage of their electricity from renewable sources. If they cannot meet that requirement, they can purchase Renewable Energy Certificates (RECs) from other producers to meet this quota.

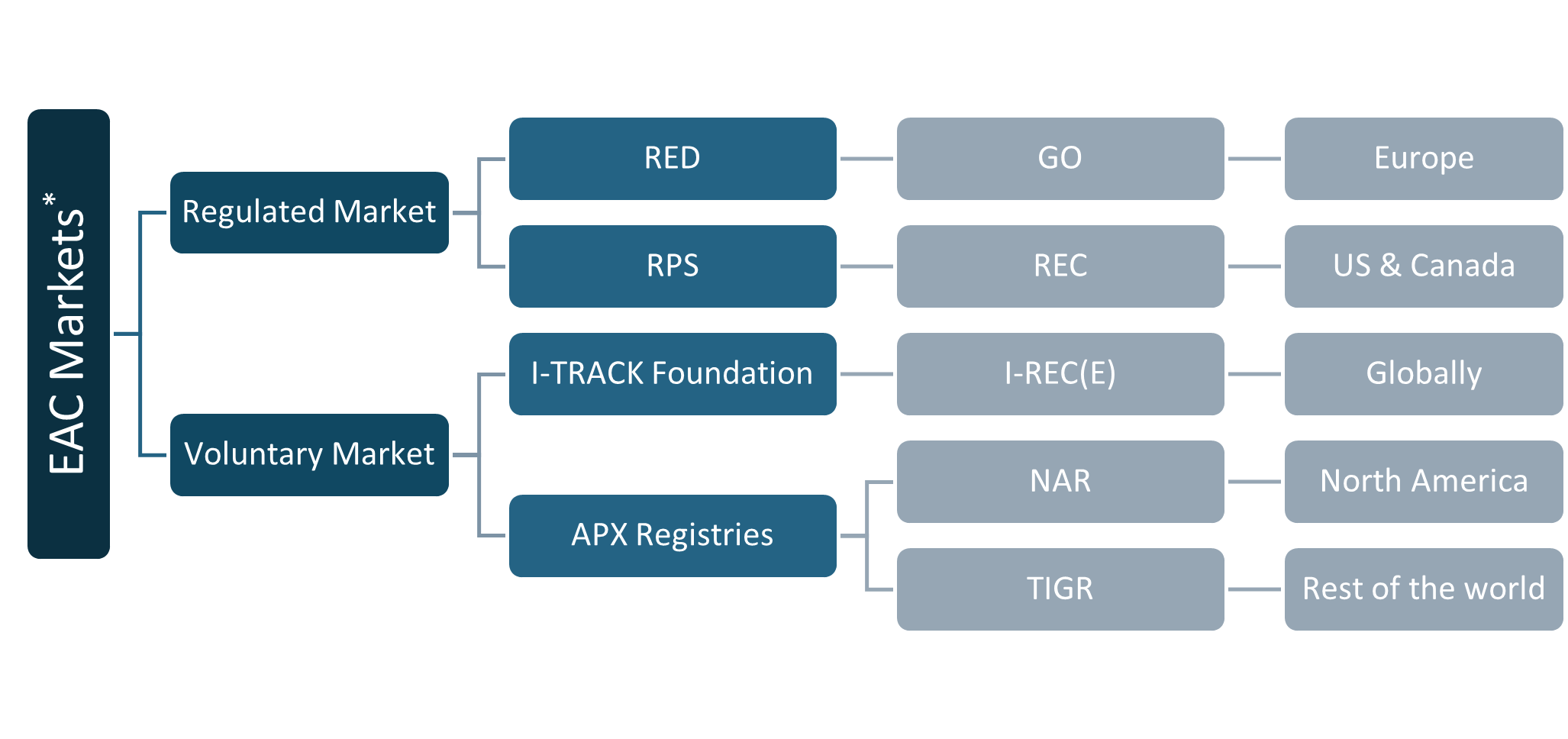

Where there are no regulated EAC markets, such as in Oman, voluntary markets (e.g. The International Tracking Standard Foundation: Founder of I-REC) are designed to provide consumers of electricity the flexibility to purchase EACs to demonstrate that they have consumed a certain type of electricity. Without this, consumers would be forced to consume the local grid mix with an average emissions factor related to all primary fuel sources connected to the grid. In this way, an EAC acts as a virtual power purchase agreement (PPA). To provide a clearer understanding, the figure below demonstrates examples of regulated versus voluntary EAC markets.

*This structure is designed to help understand the difference between the regulated and voluntary EAC markets, however, it should be noted that it does not encompass all schemes available worldwide.

The most well-known and widely used voluntary EACs are the I-REC Electricity Certificates (‘I-REC (E)’) which are accredited under the I-TRACK Foundation’s Attribute Tracking Standard (formerly the ‘I-REC Foundation’). I-REC (E) Certificates are acknowledged by major reporting frameworks such as the Greenhouse Gas Protocol (GHGP), CDP, and RE100 and they serve as a key market-based instrument for credible and auditable tracking and certification of electricity consumption. It operates in over 50 countries and I-REC (E) Certificates have been traded and redeemed in over 150 countries.

Three Pillars Consulting is the accredited local issuer of I-REC (E)s in Oman. In Oman, Nama Power and Water Procurement (NPWP) conducts periodic auctions to sell these attributes for its various renewable energy projects. TPC supports these auctions by registering and auditing these projects (i.e. devices) and subsequently issuing I-REC(E) Certificates for the energy production associated with those projects. Examples of utility-scale renewable energy devices in Oman and registered within the I-TRACK Accredited Registry (i.e. the Evident Registry) are the 50 MW Dhofar Wind project as well as the IBRI II 500 MW Solar project, among others. The certificates that are issued per MWh of electricity production from these devices can be purchased by companies to claim the use of solar or wind power from Oman’s grid, for example.

So, why would a company voluntarily purchase I-REC(E) certificates? And what happens to its GHG emission profile when it does?

To address this, it's essential to understand how Scope 2 emissions are accounted for. According to The Greenhouse Gas Protocol, there are two methods for accounting for Scope 2 emissions: (1) location-based and (2) market-based methodologies. While the location-based method reflects the average emissions of the power grid, the market-based method allows for the use of market-based instruments to verify an electricity source with a specified carbon intensity such as via the purchase of an I-REC(E).

By purchasing an amount of I-REC(E) Certificates that are equivalent to the company’s electricity consumption from the grid, they can claim a zero-emission factor for that electricity for their Scope 2 emissions. Therefore, through the use of I-REC(E)s, companies or end-users around the world can make reliable claims about the attributes (e.g. GHG emissions) related to energy that they consume from the grid. Without the use of I-REC(E)s, it would be impossible to make these reliable claims because electricity is not a tangible product that can be boxed and sent from the producer to the consumer.

Therefore, a pertinent question arises: What is the impact on the average emissions of the power grid when a company claims the purchase of Energy Attribute Certificates (EACs)?

While EACs represent the environmental attributes of renewable energy generation, allowing companies to claim zero emissions for their purchased electricity, it's necessary to recognize that this doesn't eliminate emissions entirely from the grid. The remaining electricity, often referred to as the "residual mix" still contributes emissions to the grid. The GHG Protocol's market-based method notes that the best practice for market based approaches would involve the calculation and publication of a Residual Mix Emission Factor (REF) for a robust, relevant, and accurate Scope 2 reporting approach.

Essentially, the REF helps to ensure that there is no double counting of environmental attributes from the electricity in the grid by removing, from the grid average emissions factor, the amount of grid electricity that has been claimed using a market-based instrument like I-REC (E)s. However, to do this effectively, the REF should be calculated and published as an official factor typically by an official government body or or other authority such as the grid operator or regulator. Companies that cannot utilize EACs due to lack of purchase or inapplicable contracts would then use the REF to report their Scope 2 emissions accurately under the Market-Based Methodology (as outlined by The GHG Protocol Scope 2 Standard).

Presently, Oman’s Power and Water Procurement Company (Nama Power and Water ProcurementNPWP and formerly OPWP) is leading this effort in Oman, and we, at Three Pillars Consulting, are pleased to announce we have been tasked by NPWP in the methodology development as well as the creation of a tool / software for data collection, data verification, analysis, modelling and calculations of Oman’s first ever Grid Average Emissions Factor (GEF) and Residual Mix Emissions Factor (REF). The GEF and the REF will be published on an annual basis and will serve as the official EFs that companies in Oman shall use for calculating their Scope 2 GHG Emissions under the Location-Based (for GEF) and Market-Based (for REF) Methods. The project between Three Pillars Consulting and NPWP is currently ongoing and is expected to complete by the end of Q2 of this year.

----------------------------------------------

Three Pillars Consulting provides GHG Accounting and Decarbonization Advisory Services to companies and their products. Under their ClimateTab (Trademark Pending) line of products, Three Pillars Consulting provides Excel-Based Tools and Cloud-Based Software that can support companies make quicker and more reliable calculations of their Scope 1, Scope 2, and also Scope 3 accounting.

Companies can currently purchase I-REC(E)s directly from project owners (or their agents) that registered in the I-TRACK Accredited Registry or from auctions conducted by NPWP for NPWP-related projects in Oman.

For more information on I-REC(E), particularly for registration and/or use of I-REC(E)s in Oman, please contact us at contact@threepillarsgroup.com or visit the Three Pillars Consulting website, or visit the I-TRACK Foundation website.

Looking for Expert Analysis?

Send us an email or schedule a call with us to discuss your questions and needs regarding carbon, energy, and sustainability.

Contact

Want to contact us about our services and products? Give us a call or send us a message by using the form below.

Location:

Three Pillars Consulting (TPC)

Al Noor Plaza (Building 2118), Unit 107

Al Bashair Street | Madinat Sultan Qaboos, Muscat | Oman

Postal Code 116

Email:

contact@threepillarsgroup.com

Call:

+968 2496 7611